Home

Mass Timber Rising

Sustainable Forests

Tall Wood – Low Carbon

Fuels to Frame

About

Making Cities Part of the Solution

Strong Start – Room to Grow

Mass timber construction reduces emissions from the built environment as more mass timber gets used in new tall buildings and retrofits of existing buildings. The carbon benefits accrue as mass timber becomes more widely adopted. However, if the trend loses steam and does not gain broader acceptance in the market, its climate gains will go unrealized.

So, let’s take a closer look.

Mass timber construction is a recent phenomenon in the U.S. According to WoodWorks, a non-profit organization that provides technical support for mass timber construction, less than 20 mass timber projects were initiated in 2014. Today, their numbers show that, as of June 2021 over 1,169 mass timber projects had been constructed or were in design. Importantly, new projects were occurring in all 50 states.

Can we expect the rapid expansion of mass timber to continue? Where will continued demand come from? At some point, will demand surpass manufacturing supply? The answer to these questions are important as the carbon storage and substitution potential of mass timber depends on new construction. If mass timber cannot compete with traditional building materials then its carbon storage and substitutions benefits will be limited.

But, predicting the future is notoriously tricky business. Thankfully, scientists have taken a detailed look at this question so we can leave the crystal ball behind and move into the admittedly, still murky, world of projections.

A recent peer-reviewed article from Brandt et al offers an up to date and detailed estimate of future demand for cross-laminated timber (CLT)1. The authors pulled a dataset used by utilities to forecast future power needs in the Northwest. The data provides historical and future projections of new residential and commercial buildings for Idaho, Montana, Oregon, and Washington. The authors worked backward from building estimates to gauge demand for mass timber and, correspondingly, required lumber supply.

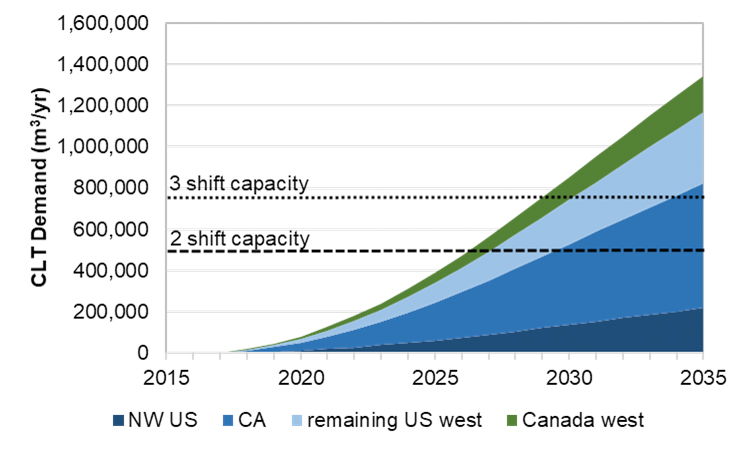

Combining the commercial building estimate with an exhaustive review of the literature, the authors concluded that demand for CLT in western North American would grow by approximately 24%. This figure aligns with research that found market penetration rates for CLT in Europe to be 30% fifteen years after introduction. The study notes that demand would be concentrated in large urban areas, with California accounting for more than half of the estimated demand in the western U.S.

Source: Brandt et al. (2021). “CLT demand and lumber supply,” BioResources 16(1), 862-881.

Brandt and the co-authors examined a range of building types and determined that just over half, 54%, of the projected buildings would be suitable for CLT construction. They noted that CLT competes particularly well in mid-rise buildings (five to eight stories) and that CLT is a “superior financial choice at eight stories.”2

These estimates indicate that demand for CLT across the western U.S. could reach 800,000 m3 per year by 2030, which is approximately four-times the current 2020 volume of 209,000 m3 per year, according to the 2021 International Mass Timber Report.

So, how does the projection of new demand square up with existing and planned manufacturing capacity and lumber production?

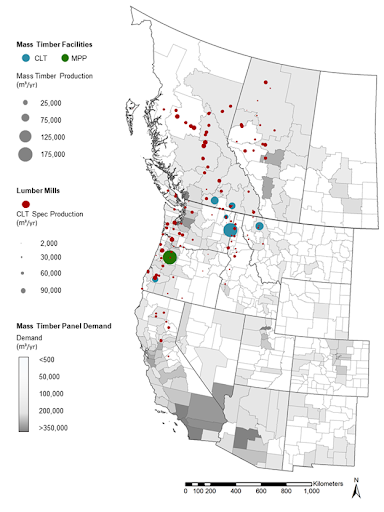

The study also compares projected demand for CLT with existing lumber production in the western U.S. and Canada. Given the location of northern CLT producers such as Katerra and SmartLam North America, the inclusion of Canadian lumber is a logical choice.

In general, the study notes that existing CLT and MPP (mass plywood panels) facilities would be able to, “meet or surpass the western North American demand until at least 2026.” They also note that demand for the lumber grades most common to CLT production (#2 or better 2×6 and 2×8) could reach 10% by 2030 without adding additional facilities or capacity, which could impact lumber prices.

Source: Brandt et al. (2021). “CLT demand and lumber supply,” BioResources 16(1), 862-881.

With six cross laminated timber facilities and one mass plywood facility in the Western U.S., the region has sufficient manufacturing capacity to service the expected 24% growth in mass timber demand in the upcoming decade.

Mass timber construction is off to a strong start and growth is expected to continue based on a solid value proposition and significant manufacturing capacity. These observations strengthen the contention that mass timber is a climate solution with considerable staying power.

2Ibid.

Making Cities Part of the Solution

Previous